Moreno Valley Integrated Resource Plan (IRP)

Energeia was engaged by Moreno Valley Utility (MVU) to develop their 2023-25 Integrated Resource Plan (IRP). As part of this process, Energeia will be analyzing

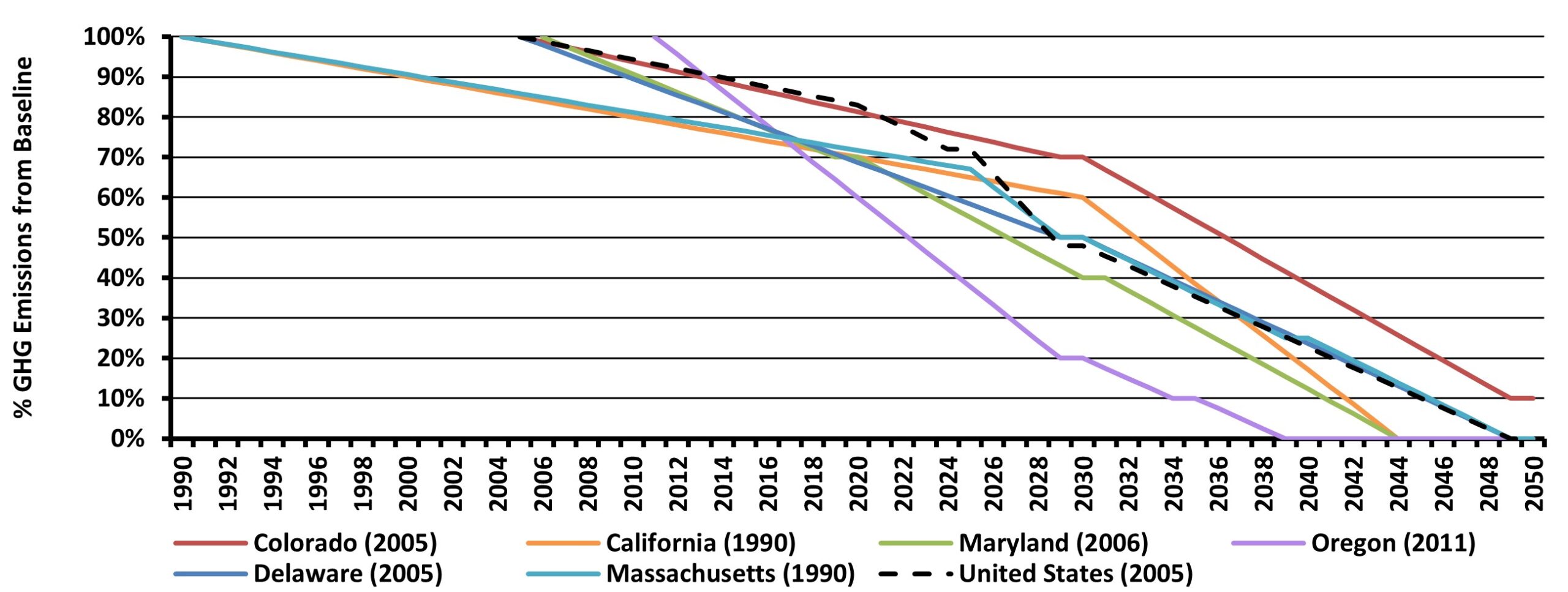

Electrification is one of the most important strategies for reducing carbon emissions in the future, as it assists in transitioning away from fossil fuels across a range of sectors, including residential, commercial, industry and transport. Figure 1 below shows the leading state and federal CO2 targets. Understanding the opportunities and challenges related to electrification is key to ensuring that policies supporting electrification are effective.

The following sections summarize Energeia’s latest research into the current gaps in the workforce to meet the development of electrification policies that align with the above leading state and federal targets. The scope of this research focused on the workforce in four key areas:

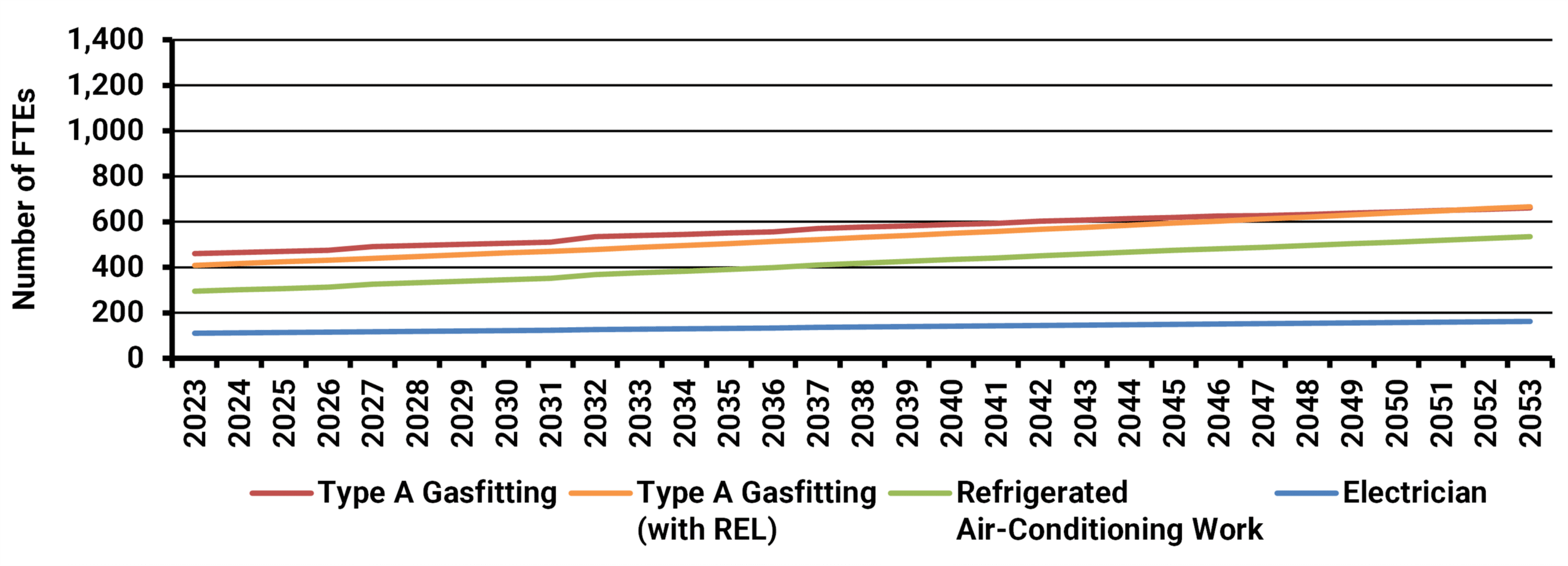

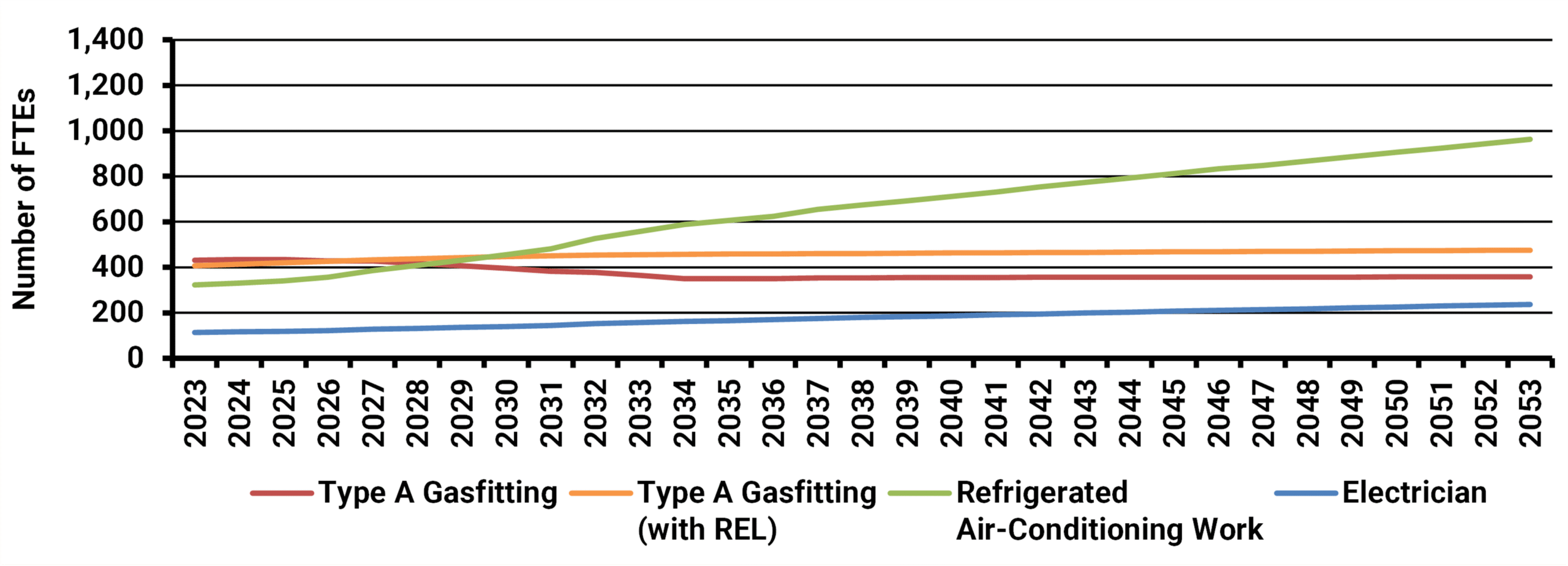

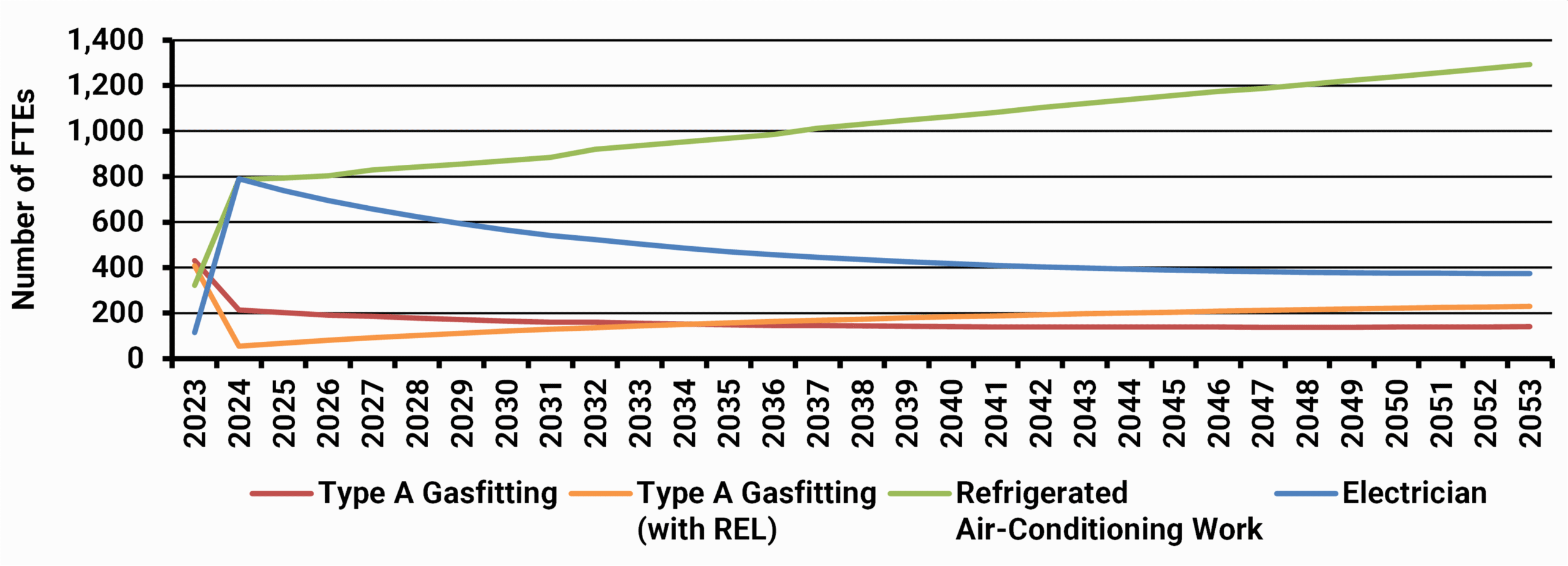

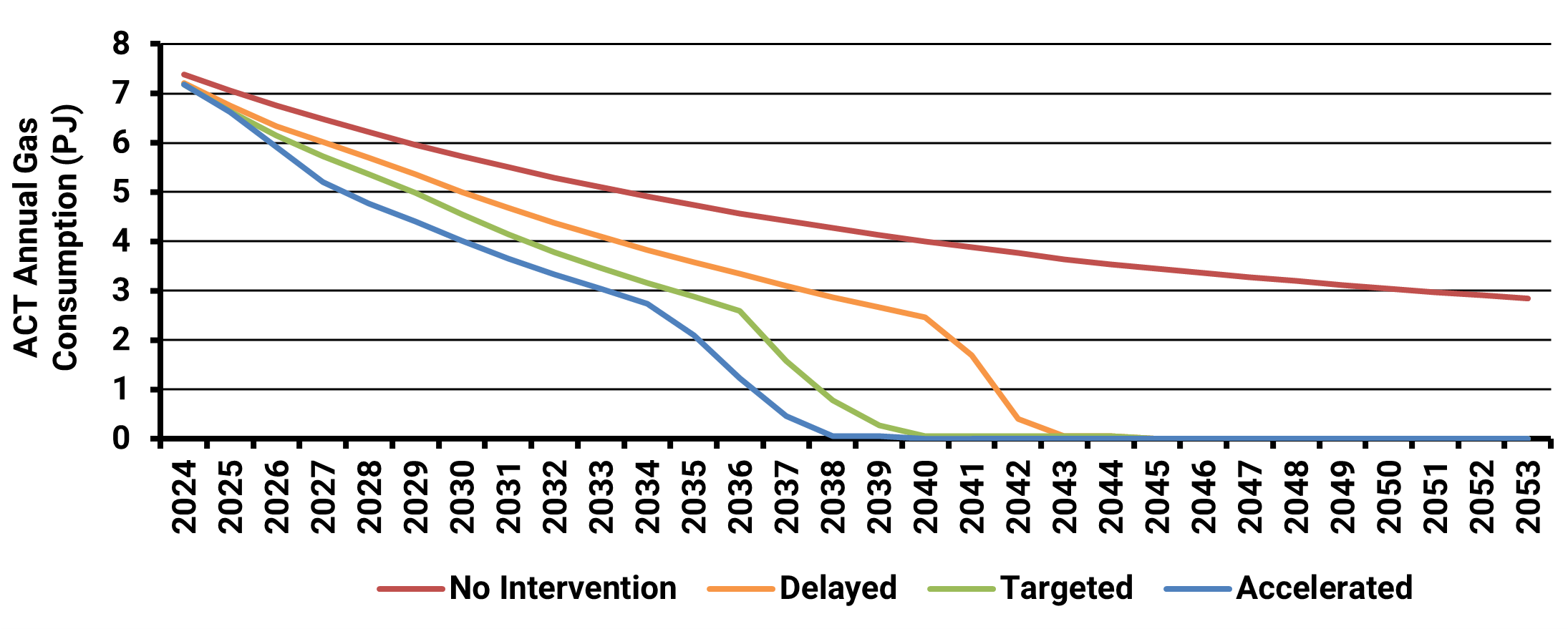

The following charts show previous Energeia analysis on the number of working hours required with different policy options for electrification of appliances. One of the Australian state governments was considering policy options to achieve faster gas system decarbonization.

The analysis considered the impact of banning gas connections in new premises, as well banning the sale of new gas appliances. The modeling showed that bans would have significant impacts on trade jobs, with Figure 2 showing the business-as-usual outcome, and Figures 3 and 4 showing the policy options gas connection ban and gas appliance ban, respectively.

The results of the scenario analysis below show that each policy option has a large increase in electric-related work hours and a decrease in gas-related work hours. Both the gas connection ban and appliance ban scenarios result in changes to workforce needs.

A key recommendation was to set bans far enough in the future to allow the market to adjust and to stagger bans. For example, start with residential water heaters, followed by space heaters, then commercial water heaters, then space heaters, and so on.

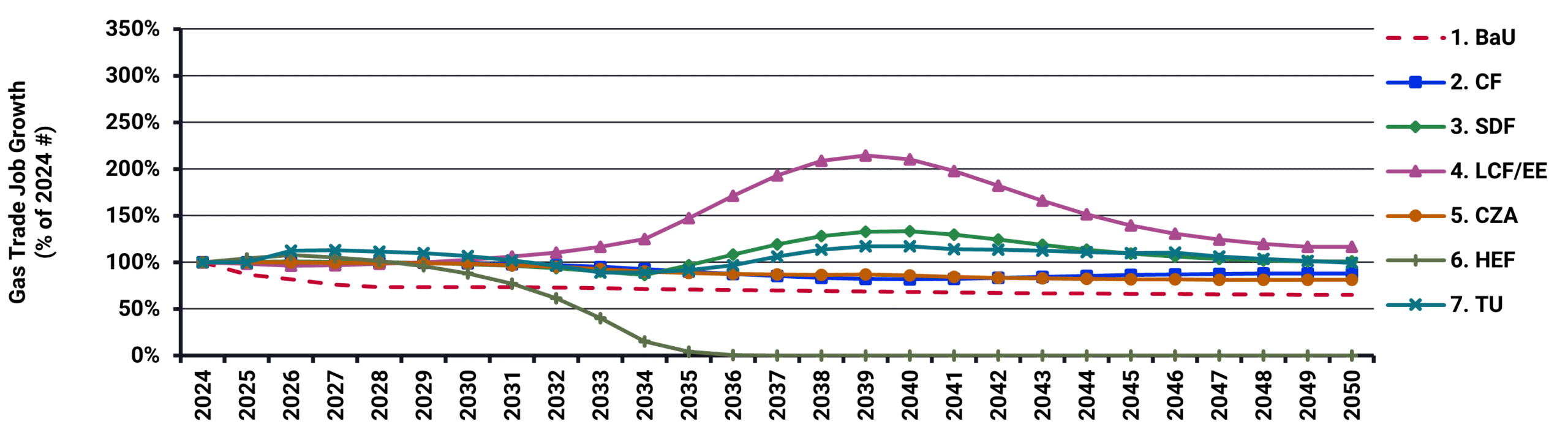

The following charts show another analysis of the number of working hours required with different policy options for electrification of appliances. The state was considering options to decarbonize its gas sector across a range of pathways, and not just electrification.

Energeia modeled the impact of each pathway on the sector, including utility and trade jobs. The impacts were mainly estimated using state FTE, throughput and installation labor estimates. The analysis highlights the significant differences in potential impact depending on the pathway chosen with a similar swing towards labor requirements for electric trade jobs.

The analysis highlights the high level of variation of skilled labour requirements across different sectors due to policy decisions and the importance of considering workforce shortages on policy implementation.

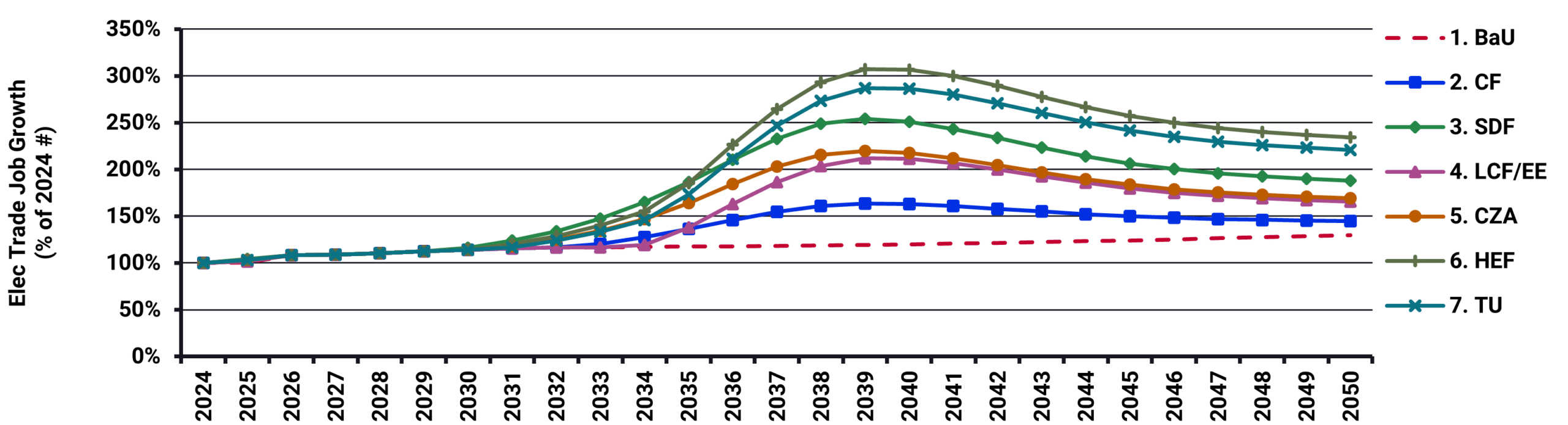

Electricity utilities are changing over time as the grid transitions to 100% renewable energy. With a changing grid comes changing workforce requirements. The figure below demonstrates the change in the number of employees needed by the electricity industry of a US state.

Moving to a 100% renewable grid requires a more decentralized system, requiring a large shift in focus and reallocation of the spending and workforce.

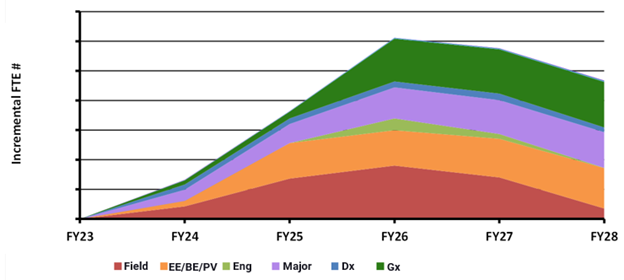

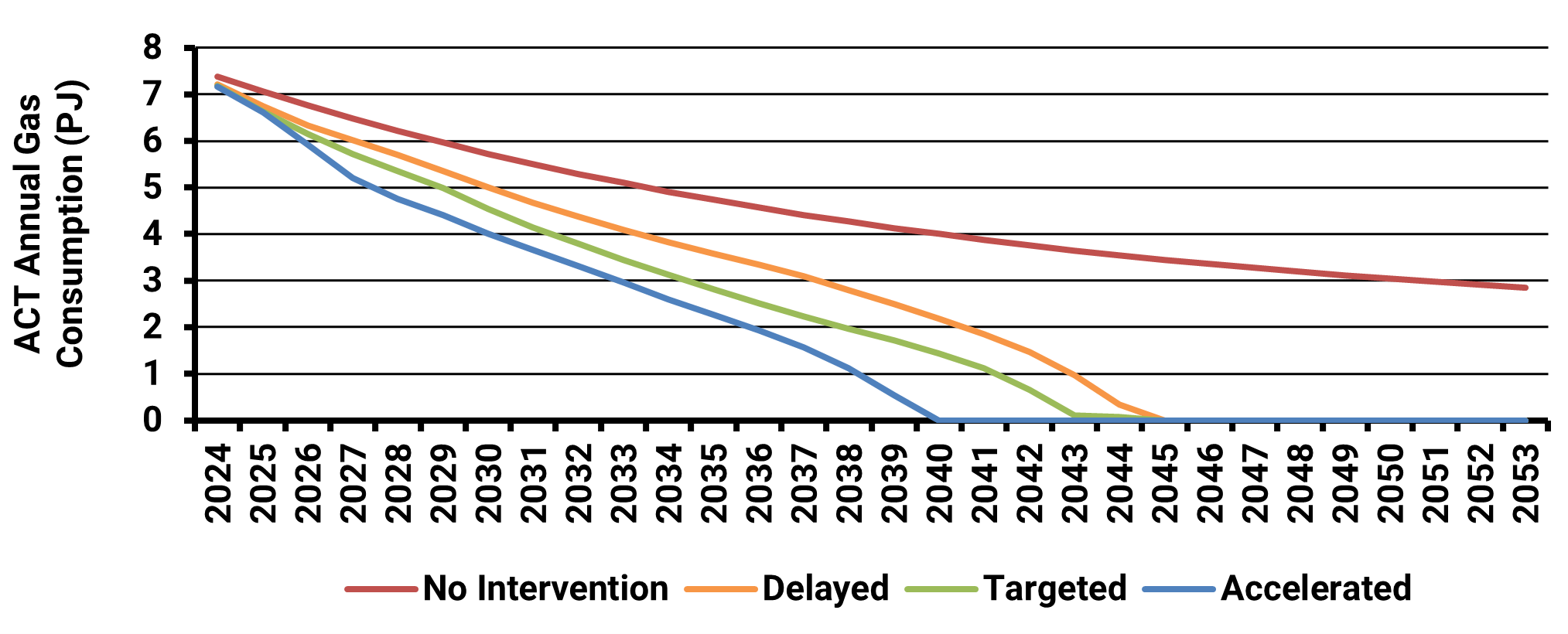

The government of the Australian Capital Territory (ACT) were considering methods of shutting down the gas network over time, as well as different policy options that would assist in transitioning people off gas. The figures below show two different methods for shutting down the gas network. The first is to shut down portions of the gas network once consumption has fallen below a certain threshold and the second is to shut down an equal portion each year.

The two methods, which are achieving similar outcomes, have very different timing. The difference in these two graphics show the importance of considering timing in policy implementation and the importance of skilled labor as a planning constraint.

Listen or click through at your own pace

The following section outlines the analysis and directions towards anticipating workforce requirements resulting from consumer or policy-driven electrification.

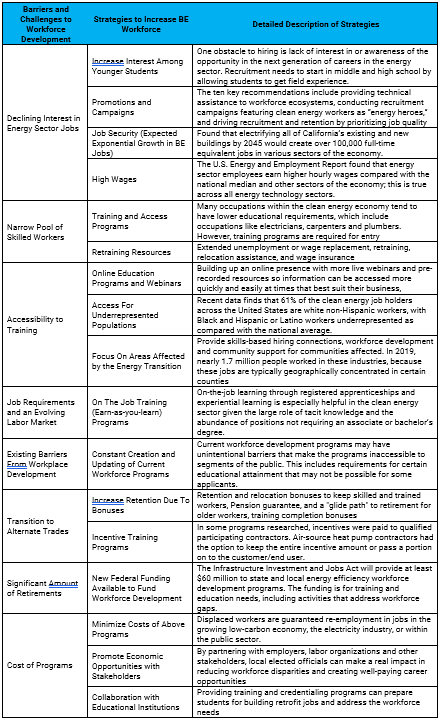

Energeia has summarised key workforce barriers shown are from both contractor interviews and research. Interviewees cited barriers such as the competitiveness of wages, blue-collar job stigma, retraining incentive availability and uncertainty around demand for green jobs.

Table 1 below summarizes the identified barriers which included a decline in energy job interest, a small pool of workers, a lack of training access, and high entry requirements.

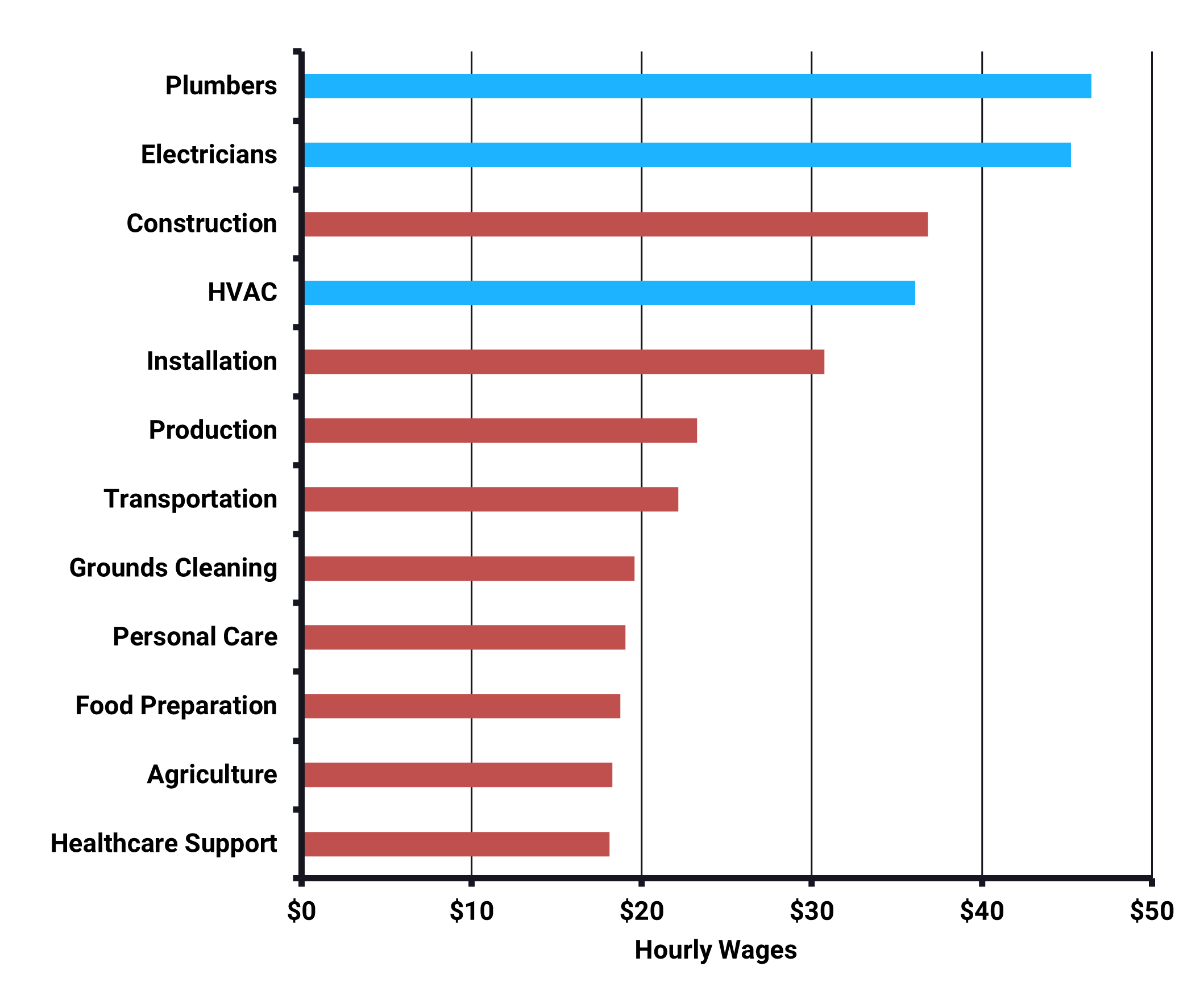

Energeia analyzed hourly wages for blue-collar jobs and compared them to the hourly wages of the contractors who install building electrification appliances. The findings showed that plumbers, electricians, and HVAC professionals all make significantly more than most non-BE blue-collar jobs in this example.

The only non-building electrification blue-collar job that makes more than contractors related to building electrification technologies is construction, which makes ~$1 more per hour than HVAC professionals

The following table summarizes the challenges and associated strategies to overcome these challenges in the electrification workforce.

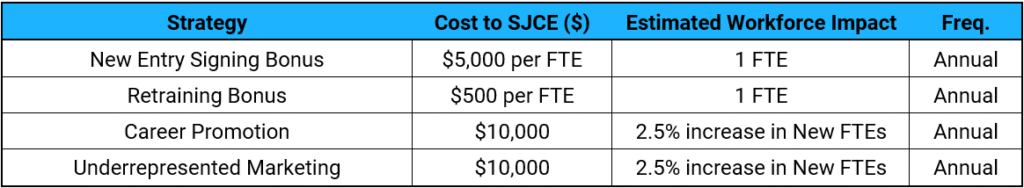

On the basis of the above challenges and solutions, Energeia developed a targeted workforce strategy that addresses key workforce barriers. Table 3 below captures the estimated costs and workforce impacts of each solution.

Energeia developed an estimate of the cost of process improvements and advertising campaigns based on experience, but these numbers should be validated.

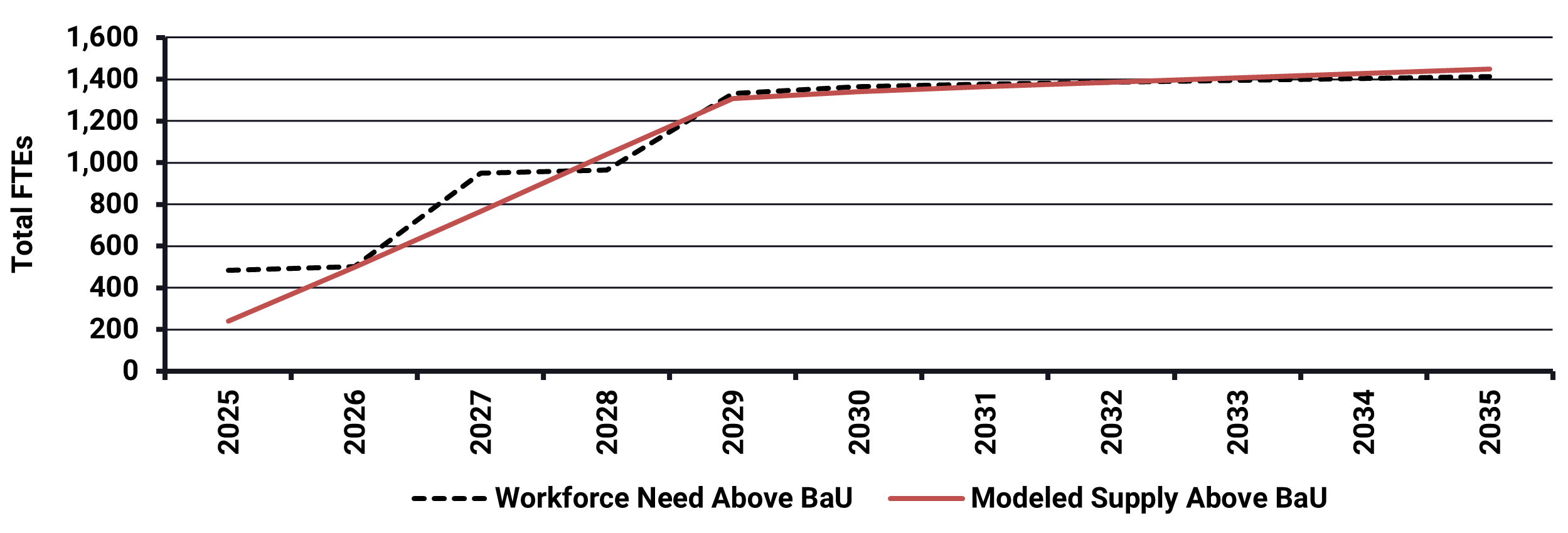

The annual impacts of the workforce development program were estimated, as seen below in Figure 8. This includes strategies for increasing the efficiency of the existing workforce, e.g., instant permits and streamlining. The plan was smoothed to reflect the realities of hiring and program implementation (ideally, it should ramp up). The resulting workforce transition is shown below against the target needed to hit the building electrification goals.

Petrochemical and chemical production have very high abatement costs, as shown in Figure 8 below, with carbon capture the lowest cost solution to full abatement, and hydrogen alternatives the highest cost solution of any hard-to-abate solutions considered.

Energeia’s key takeaways and recommendations for tackling the skills gap in the workforce implementing electrification (derived from Energeia’s best practice research and innovative analysis) are summarized below.

Key Takeaways:

Key Recommendations:

Energeia was engaged by Moreno Valley Utility (MVU) to develop their 2023-25 Integrated Resource Plan (IRP). As part of this process, Energeia will be analyzing

Energeia’s research and data engineering expertise proved essential in building a comprehensive custom database of utility grid infrastructure spatial data for each target market.

Los Angeles Department of Water and Power (LADWP) gathered a team of leading industry experts, including Energeia, to develop an Integrated Human Resources Plan (IHRP)

US Office

Mansion Square

Suite 380, 132 E Street

Davis, CA 95616

Phone: +1 (530) 302-3861

Fax: +1 (530) 419-2572

USA@energeia-usa.com

energeia-usa.com

Sydney Office

Energeia Pty Ltd

WeWork

L1, 1 Sussex St

Barangaroo NSW 2000

Phone: +61 (0)2 8097 0070

ABN: 15 134 783 412

consulting@energeia.com.au