- Webinars

Optimizing Behind-The-Meter (BTM) Rates and Incentives

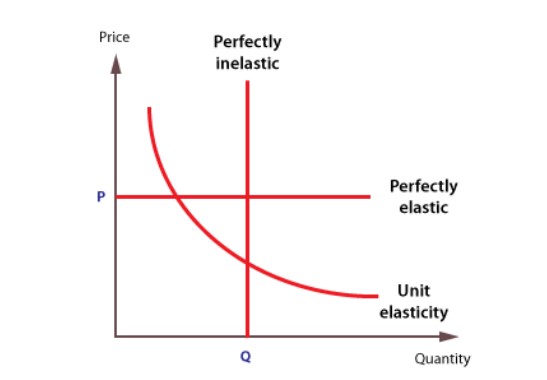

Electricity has historically exhibited what economists call inelastic price elasticity of demand, in that a change in pricing has not historically led to a change in demand, which has governed how electricity has been priced for around 150 years. Due to advances in technology, this is all changing dramatically, thus emphasizing the need to maxmise efficient consumer energy resource rates and tariffs.

Price Elasticity of Demand

The characteristics of traditional electricity economics are driven by the lack of energy substitutes, the inability to store large volumes of electricity along with the high costs to respond efficiently to high prices.

As rooftop solar PV, battery storage and ultimately, vehicle-to-x technologies, create generation alternatives and the means to store energy, artificial intelligence (AI) has the potential respond to pricing fluctuations. All this indicates none of the above characteristics of price inelasticity will remain true in the very near future.

As we move towards a future where customer agents, such as AI, can respond in real-time to electricity price signals and control more of our energy demand and supply, it is critical that these price signals are efficient. Otherwise, consumer energy resources (DERs) could be wasted or even operate to increase system costs.

For example, if all DERs respond to the same off-peak price signal, they may all start generating electricity at the same time, creating a new peak. This would be inefficient and would increase costs for everyone.

To avoid this, it is important to have electricity price signals that accurately reflect the real-time cost of generating and delivering electricity. This will help to ensure that DERs are used in the most efficient way possible.

Economic Efficiency in Energy

Economists agree on three complementary measures of economic efficiency: productive, allocative, and dynamic, that account for fluctuations and causal relationships between cost, prices, demand and technological progress. Using Gregory Mankiw, author of Principles of Economics, who defines these measures, we can overlay these principles onto an electricity system.

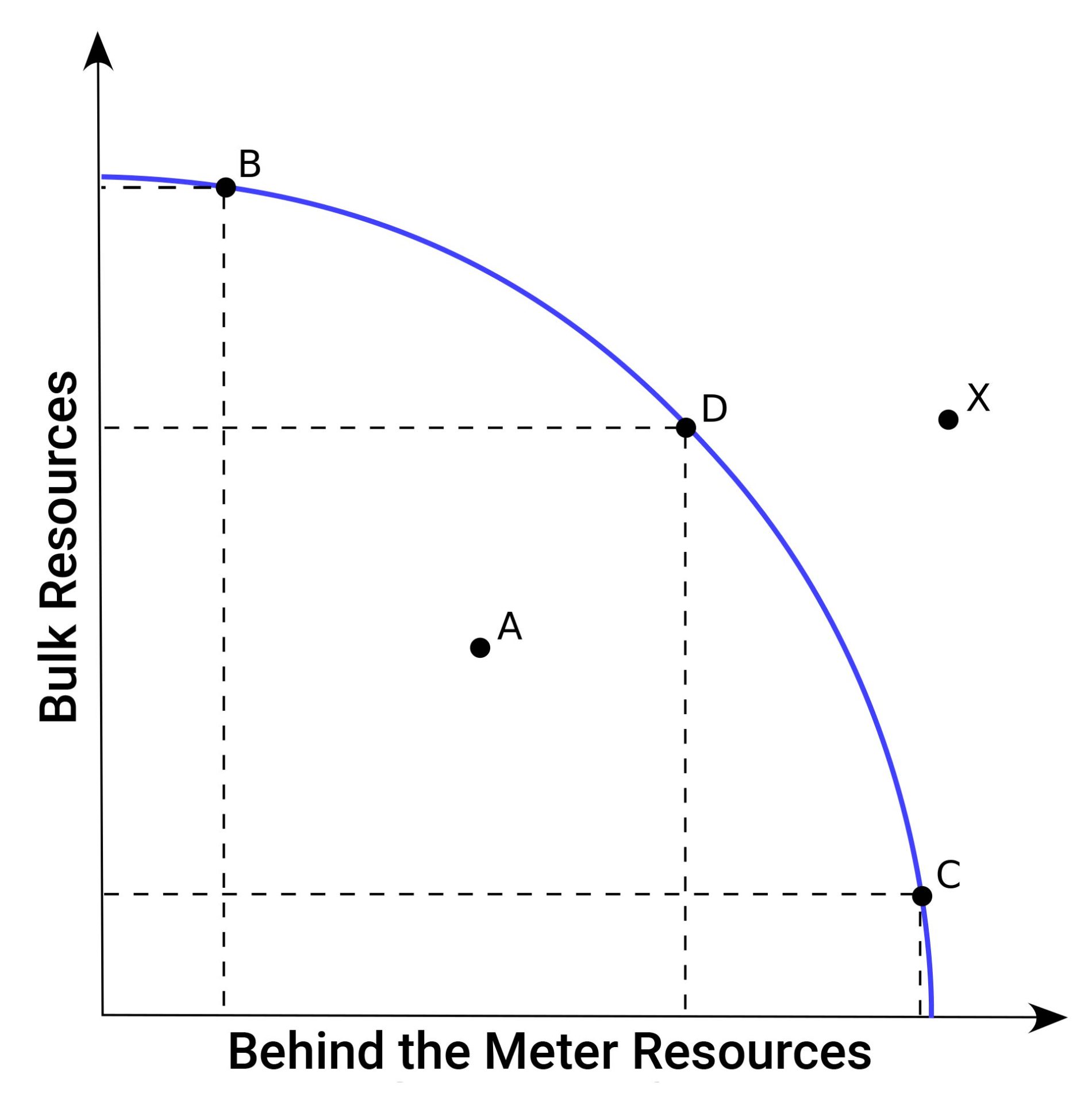

Productive efficiency is defined as the state of affairs in which the inputs used to produce a given output are minimized and thus operating on its production possibility frontier.

In terms of energy decarbonization, an example of productive efficiency can be represented in any least cost CO2 pathway to net zero emissions. In other words, that will reduce greenhouse gas emissions to a target level at the lowest possible cost.

The figure below shows a range of combinations of centralised (bulk) resources and decentralised resources, each sitting on the efficient frontier. If centralised resources are used more than the ratio described in theory below, the result will be lower system efficiency.

The figure below reports on the projected net benefits of implementing NREL’s identified strategies, with space and water heating measures the majority contributors to savings. The data also shows that most of the net benefits will occur in the 2030 to 2050 timeframe.

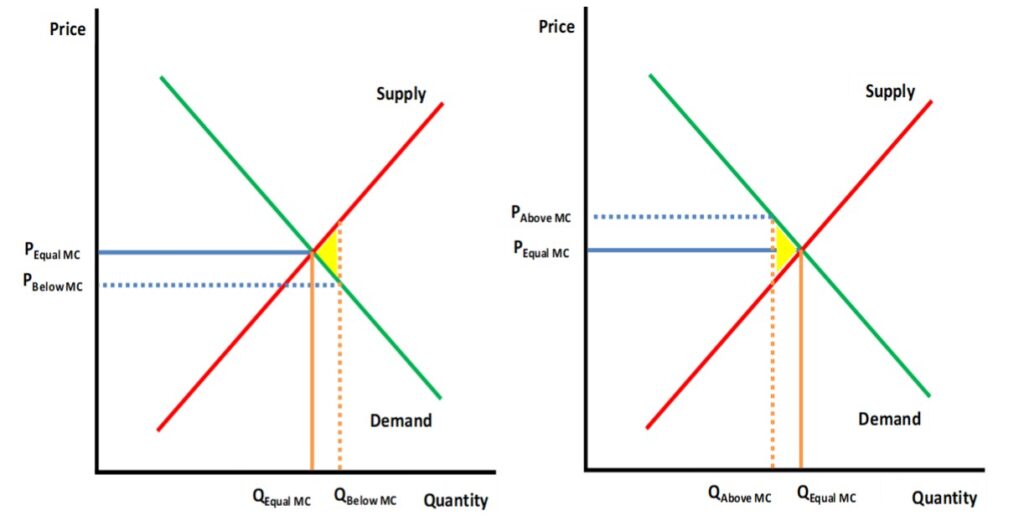

Allocative efficiency is defined as the state of affairs in which the quantity of each good or service produced is equal to the amount that consumers are willing to purchase at the prevailing prices.

In terms of efficient Consumer Energy Resources, we need to take the quantity versus price one step further and examine the rate of change between these two variables, better known as marginal cost and marginal demand. Previously, without alternative energy options, energy prices peaked with system peak demand, based on the marginal cost to meet the demand. Now that alternatives and storage systems are available, during peak demand periods/high price periods consumers are able to switch to stored energy, mitigating high prices and lowering the demand on the grid. The goal of efficient rate and incentive design is to balance marginal cost to equal marginal demand.

Where this is not the case, due to monopoly power, for example, then we will see under consumption where prices are too high, and under consumption where prices are too low, resulting in what economists term deadweight loss. We can also call this avoidable inefficiency, as shown in the figure above.

Dynamic efficiency is defined as the state of affairs in which technological progress is maximized. The development and deployment of renewable energy technologies is a classic examples of dynamic efficient in the energy industries. Renewable energy technologies, such as solar and wind power, are becoming increasingly cost-competitive with traditional fossil fuel-based energy sources, increasing adoption and revenue, thus perpetuating the next cycle of investment and lowering costs over time.

The future health of the energy economy will rest is the achievement of all three efficiencies.

Accurate costs are a key precedent to achieving productive efficiency, as is consumer level uptake forecasting or demand for allocative efficient, thus informing the price and marginal revenue, which should circle back around to equal to marginal costs.

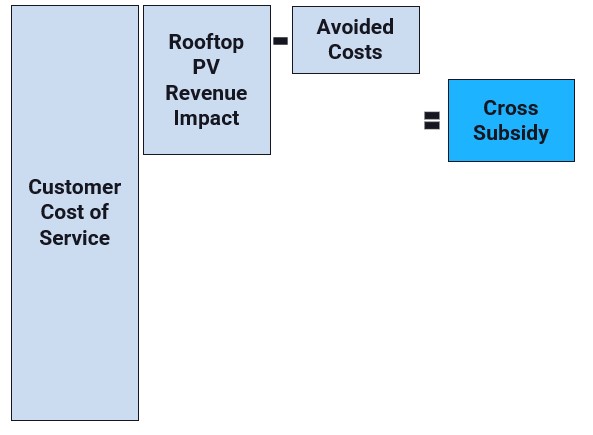

Current incentives for solar PV for customers without cost-reflective pricing are a topical example of where Marginal Cost (MC) is not being set to Marginal Revenue (MR). The figure below illustrates how the reduction in the electricity bill, which is greater than avoided costs of delivering that electricity, results in a cross-subsidy, and over consumption of solar PV.

It is important to note that Marginal Costs varies depending on the time horizon being considered. Short-run-marginal-cost (SRMC) is typically different to long-run-marginal-cost (LRMC). SRMC only includes variable costs in the short term, while LRMC typically assumes[1] a horizon where all costs are variable.

Due to the capital-intensive nature of centralised electricity supply infrastructure, where grid assets can last 50-70 years, and future costs are lower than historical costs due to technology and industry learning improvements, it is possible for LRMC to be less than historical costs.

Regulated utilities are typically allowed to recover their efficient historical costs, and they can without distorting the MC = MR relationship.

Listen or click through at your own pace

Social Implications

Differences in upfront costs for gas vs. electric equipment and appliances are a key barrier for anyone with:

- capital constraints; or

- where there is a split incentive between the owner and the occupier of a premise; or

- where the value of the investment cannot be fully recouped, for example due to only being in the premise a few years compared to a 12-year investment horizon.

The figure below shows illustrative (actual relativities vary by jurisdiction) expenditure relativities between different options for a 4-year investment horizon, which reflects typical residential and commercial lease tenancies – before any government incentives. Gas is generally the least cost option, though results are highly sensitive to local conditions such as gas and electricity relativities. Heat pumps, which may be more cost effective over a 12-year period, are unlikely to be selected by rational investors, due to their bounded conditions such as tenancy duration and the inability to recover the residual value in the resale value of the premise or via a deal with the landlord.

The State of the Art in Maximising Efficient Consumer Energy Resource Rate and Tarrif Design

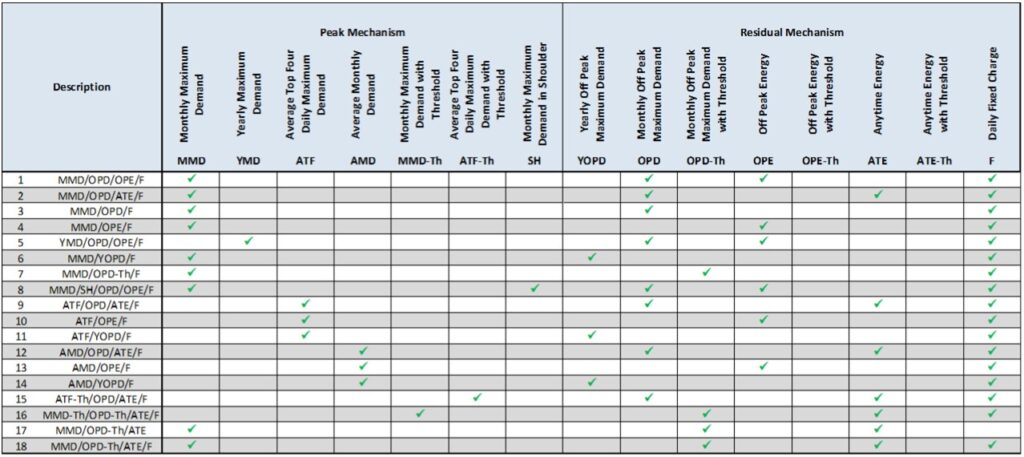

Energeia’s review of tariff designs and DER incentives in Australia found that they fell short of efficient for the following main reasons:

- Peak periods not based on forward looking, weather normalised periods of congestion

- Peak prices not based on LRMC for centralised or decentralised resources

- Rate designs not reflective of Ramsey pricing

- Incentives do not reflect LRMC net of tariff impacts

Detailed information regarding efficient peak period design is contained in the webinar, as is information regarding efficient LRMC for centralised and decentralised resources.

Selected DER uptake results, representing a short list of the above combination of options, are shown in the figure below. Solar PV adoption in this jurisdiction was around 19% at the start of the period. By the end of the period, it ranged from around 19% to as high as 59%, due to the rate design.

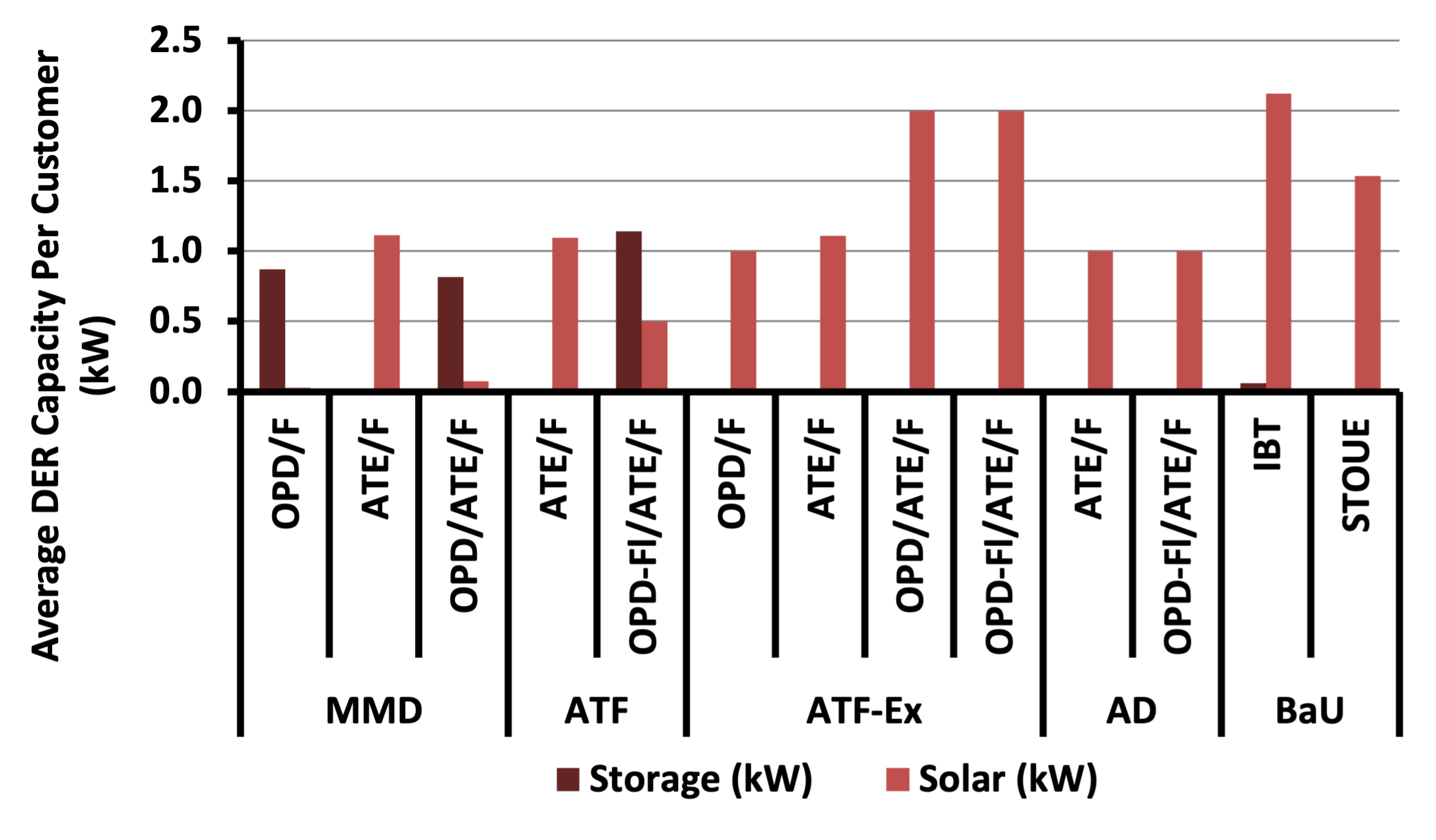

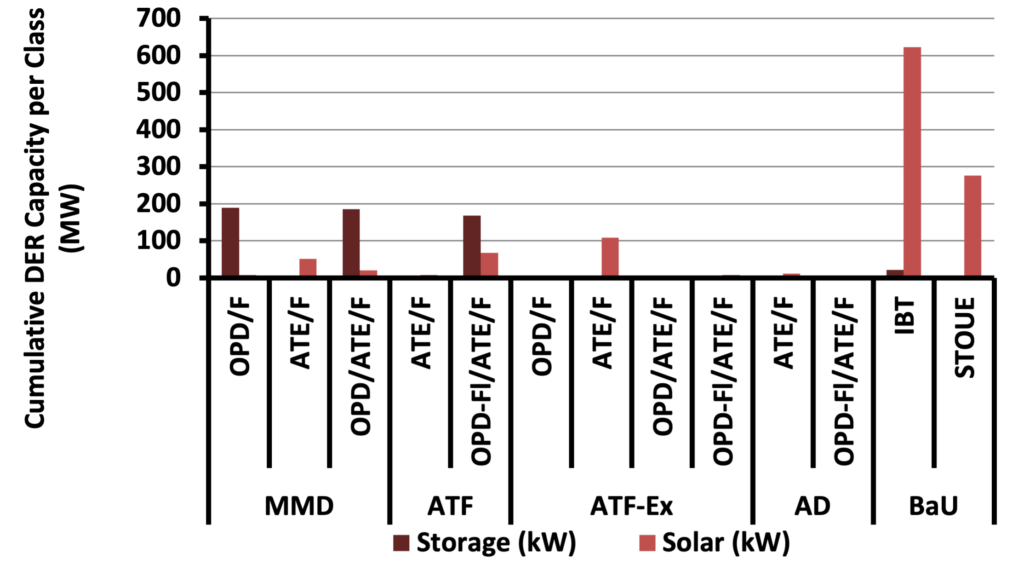

Adoption rates are one factor, but the real test of the impact of a rate is on the level of DER adoption in terms of capacity, which is reported in the figure below. It tells a very different story than penetration alone, with a range of DER mixes and absolute levels.

Perhaps unsurprisingly, the business-as-usual (BaU) rates, being Inclining Block and Seasonal Time-of-Use energy, the two most popular designs in Australia and the US, shows the highest levels of DER adoption, which are almost entirely solar PV, with very little battery storage.

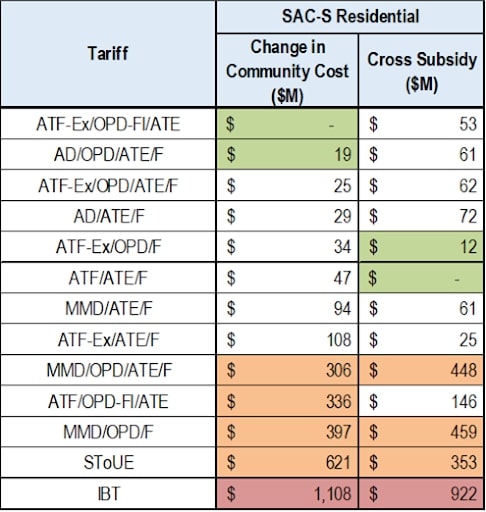

Figure 8 delivers the key result in terms of which of the designs achieves the greatest productive efficiency, which also typically minimise cross-subsidies. Lower cross-subsidies also mean better Ramsey Pricing outcomes.

Interestingly, no single factor seems to deliver the most efficient outcomes. ATF, OPD and ATE are in the lowest cost as well as highest cost designs. Monthly max demand, one of the most popular peak period pricing mechanisms, tends to result in lower efficiency outcomes.

Figue 9 delivers the key result in terms of which of the designs achieves the greatest productive efficiency, which also typically minimise cross-subsidies. Lower cross-subsidies also mean better Ramsey Pricing outcomes.

Interestingly, no single factor seems to deliver the most efficient outcomes. ATF, OPD and ATE are in the lowest cost as well as highest cost designs. Monthly max demand, one of the most popular peak period pricing mechanisms, tends to result in lower efficiency outcomes.

It is important to note that the above example is from 2017, when solar PV and storage costs were much higher. Recent projects have resulted in significant increases in efficient Consumer Energy Resource resources, as their marginal costs fall relative to centralised system marginal costs.

In situations where it is not possible to achieve major tariff reforms, or as a stop gap measure, incentives such as rebates or annual payments can help send efficient price signals.

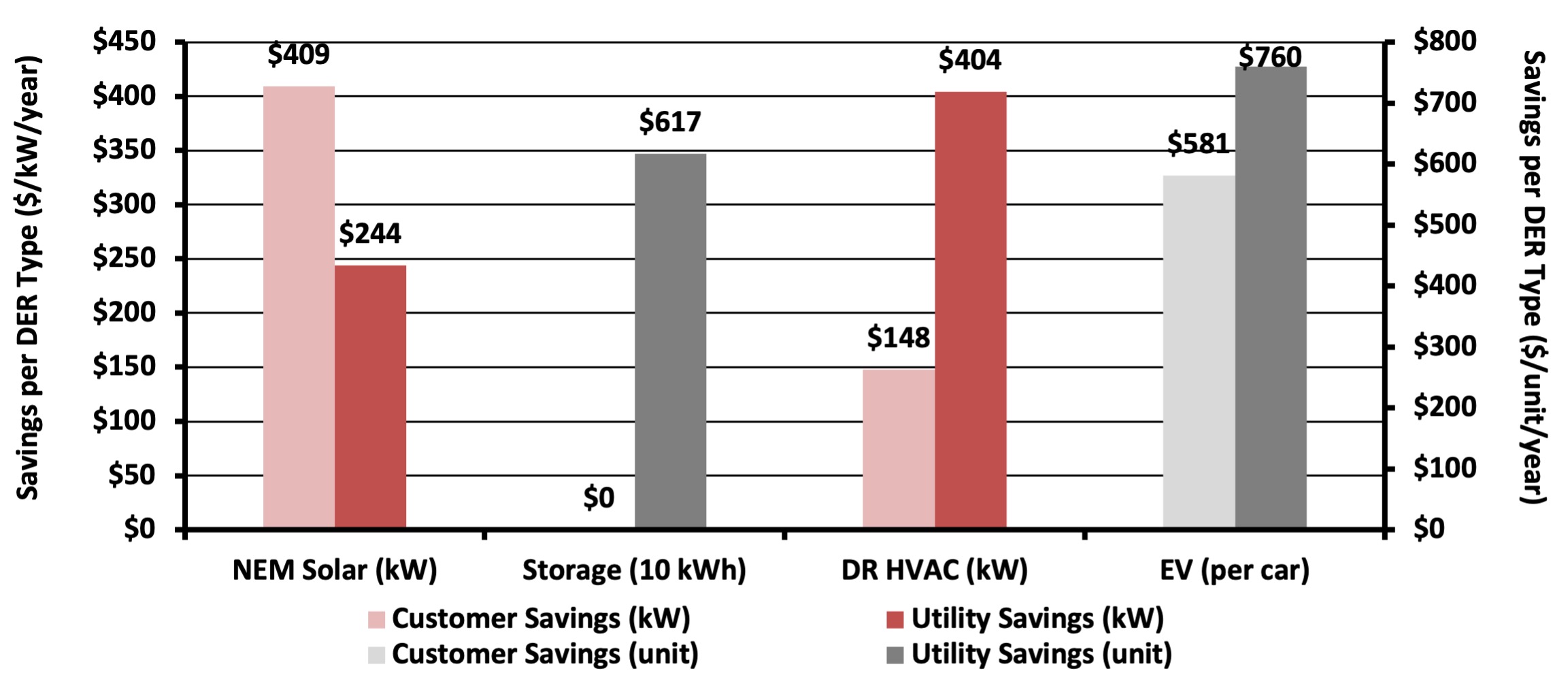

The figure below shows how efficient DER incentives should be developed, net of tariff impacts. Solar PV savings (incentives) are above utility savings, and the only way to address that is to use more cost reflective tariff designs. Bill impacts from other DER is under the utility savings, and the role of the efficient incentive is to bridge those gaps.

Takeaways and Recommendations

While most in the energy can agree with and apply Einstein’s mass-energy equivalence, E = mc2, and Newton’s second law of thermodynamics, the industry has been slow to apply the economic principle of MR = MC, marginal revenue equals marginal cost, causes inefficiencies that could have costly and environmentally and socially harmful ramifications.

Key Takeaways

- Rates and incentives are a primary driver of DER adoption and operation

- Virtually all rates and incentives do not reflect key economic principles, resulting in inefficient adoption and operation

- Key reforms needed include unbundling, locational, accurate LRMC and period calculation, and fair residual cost allocation

- Efficient tariff and incentives will deliver 2-3 times more DER, in the right places, at the right times, in the right mix

- Reform will not increase costs for the disadvantaged or undermine efficient network investment or operation

Key Recommendations

- A rule change is probably needed to unbundle the transmission and distribution portions of tariffs, to ensure an optional tariff is made available and is designed correctly

- Real-time pricing is nice to have, but 90% of benefits will come from unbundling, and improved cost and period accuracy

Watch the full webinar playback below and follow along with the complete presentation.

You may also like

Moreno Valley Integrated Resource Plan (IRP)

Energeia was engaged by Moreno Valley Utility (MVU) to develop their 2023-25 Integrated Resource Plan (IRP). As part of this process, Energeia will be analyzing

BESS Forecasting for an Array of Cities Nationwide

Energeia’s research and data engineering expertise proved essential in building a comprehensive custom database of utility grid infrastructure spatial data for each target market.

LADWP Develops an Integrated Human Resources Plan to Aid the LA100 Program

Los Angeles Department of Water and Power (LADWP) gathered a team of leading industry experts, including Energeia, to develop an Integrated Human Resources Plan (IHRP)