- Webinars

Removing Building Electrification Barriers

Buildings account for a significant portion of the United States’ annual emissions, mainly due to the burning of gas for water and space heating, as well as other common uses like cooking. Electrification of these end uses alongside power system decarbonization is a key decarbonization strategy being pursued at the Federal, state and local level. The main barriers to implementing this strategy includes:

- Higher cost electric appliances

- Consumer preferences (i.e. natural gas for cooking) and low awareness of available technology

- Higher electricity grid costs

- Industry labor capacity limitations

The following sections describe best practice approaches to removing each of these barriers, based on more than 10 projects Energeia has completed in the U.S. and Australia.

U.S. Building Emissions and Electrification

U.S. emission reduction targets are driven by the Paris Agreement, which the U.S rejoined in 2021. U.S. targets include a 50-52% reduction in 2005-level (baseline) emissions by 2030, and a net-zero goal for 2050.

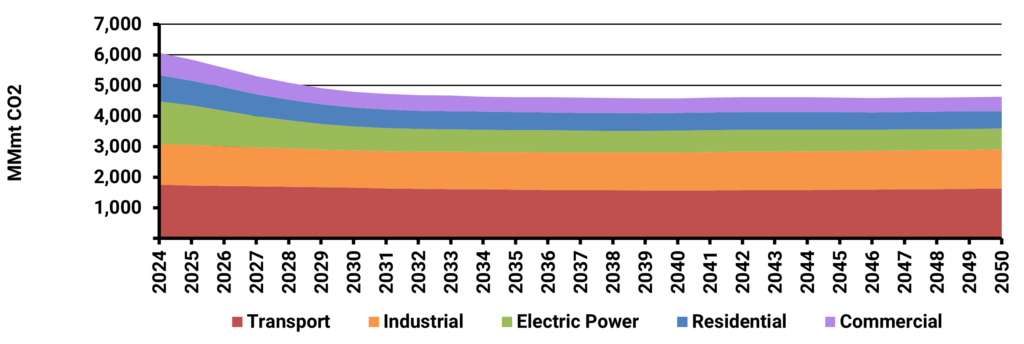

Baseline U.S. emission projections from the EIA are relatively flat, which, given economic and population growth, already reflects some savings from the development and adoption of new technology.

The above graphic shows that the majority of U.S. emissions come from the transport and industrial sectors, with residential and commercial end uses accounting for 35% of the U.S. emissions total in 2022 (Lawrence Berkeley National Lab (LBNL), 2023). Most emissions are relatively flat other than for electric power, which reduces over time as the share of renewable energy increases.

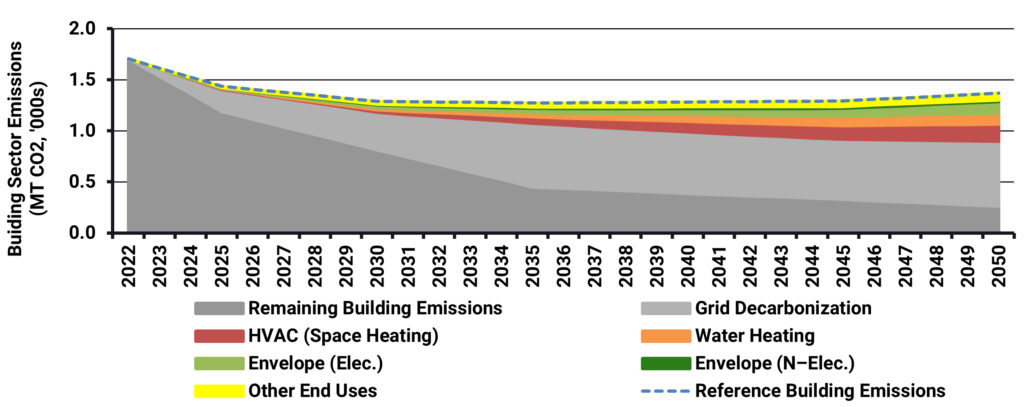

A 2024 LBNL study of demand-side pathways for building sector emission reductions found that up to a 91% reduction in building sector CO2 emissions from 2005 levels by 2050 was possible with aggressive implementation of electrification, energy efficiency, and demand flexibility measures. The figure below reports on building sector emissions over time, demonstrating the sequencing of potential CO2 emissions reductions by measure type (HVAC, water heating, etc.)

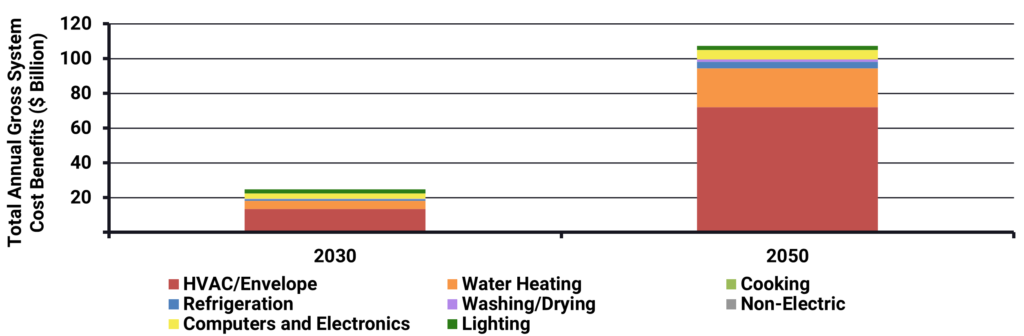

The figure below reports on the projected net benefits of implementing NREL’s identified strategies, with space and water heating measures the majority contributors to savings. The data also shows that most of the net benefits will occur in the 2030 to 2050 timeframe.

LBNL’s modeling suggests a total of $107 billion in annual power system cost savings could be achieved by 2050. LBNL’s scenario assumes the majority of these savings, and therefore the uptake of these strategies, occurs between 2030 and 2050, with the majority coming from electrification in the residential sector, as shown in the figure below.

While the above national analysis helps point the way, state and local jurisdictions will need to develop their own estimate of the optimal pathway to decarbonizing buildings. The following sections summarize a best practice approach to identifying it.

U.S. Building Electrification Potential

The pace of transition building emissions from the current state to a zero carbon, fully electrified future state, is governed by the rate of premise and equipment turnover, the regulations and incentives in place, and the underlying technology and fuel costs:

- Rate of new premises – New buildings are an important market segment for targeting regulations, standards, programs, and incentives.

- Rate of building remodeling – This usually triggers new regulations such as no new gas appliances, etc.;

- Rate of appliance turnover – Appliance bans can be at point of sale, but incentives can be used encourage voluntary electrification as well; and

- Retrofit programs– Almost never used due to their relatively high costs, they will become essential for the orderly decommissioning of the natural gas system.

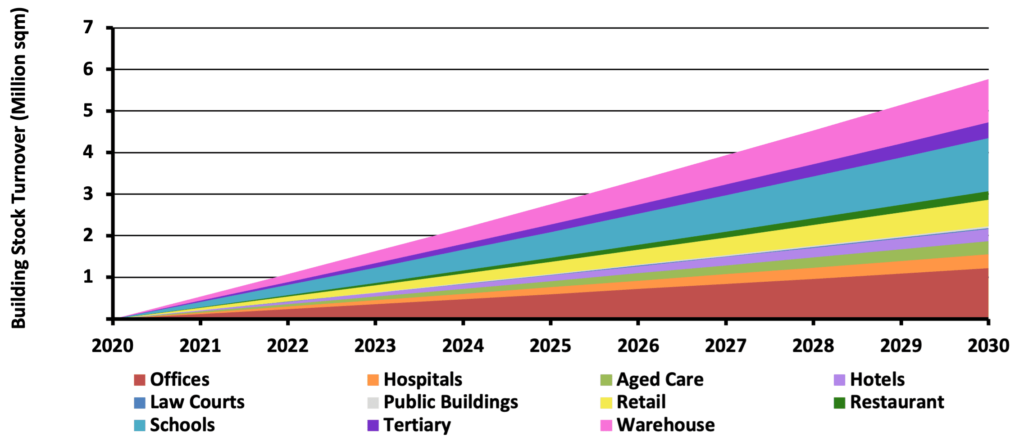

The rate of new buildings and premises is largely a function of economic activity and can be relatively easily gleaned from utility growth forecasts. New buildings are subject to prevailing building standards but can also be influenced by programs and incentives. The figure below is taken from recent work we did on the commercial sector.

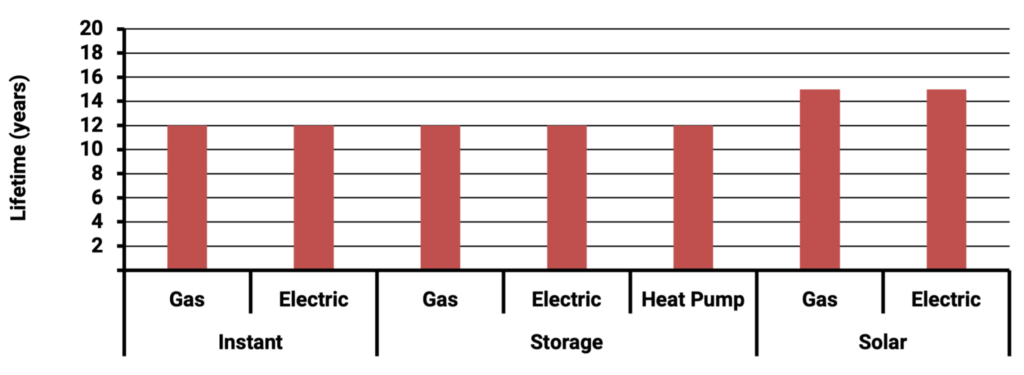

The rate of appliance turnover outside of major remodels is driven by appliance lifetimes, as most are replaced at end of life. The figure below for water heating technology shows there is not much difference between appliance lifetimes. However, another key insight from this data is that once installed, there will not be another chance to electrify them for over a decade.

Listen or click through at your own pace

Turning the above drivers of potential electrification into actual electrification depends on overcoming the key barriers foreshadowed earlier.

Addressing Appliance Cost Barriers

Differences in upfront costs for gas vs. electric equipment and appliances are a key barrier for anyone with:

- capital constraints; or

- where there is a split incentive between the owner and the occupier of a premise; or

- where the value of the investment cannot be fully recouped, for example due to only being in the premise a few years compared to a 12-year investment horizon.

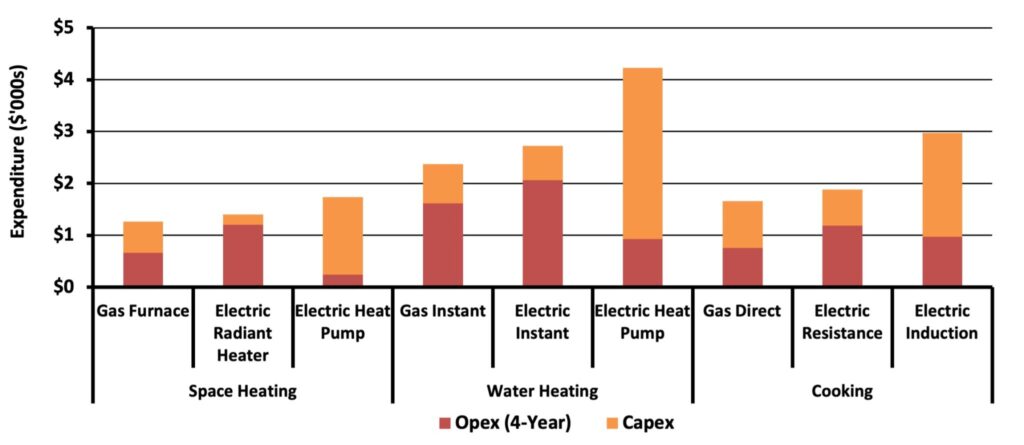

The figure below shows illustrative (actual relativities vary by jurisdiction) expenditure relativities between different options for a 4-year investment horizon, which reflects typical residential and commercial lease tenancies – before any government incentives. Gas is generally the least cost option, though results are highly sensitive to local conditions such as gas and electricity relativities. Heat pumps, which may be more cost effective over a 12-year period, are unlikely to be selected by rational investors, due to their bounded conditions such as tenancy duration and the inability to recover the residual value in the resale value of the premise or via a deal with the landlord.

Best practice building electrification programs often ban options that are known to be a bad investment, e.g. resistive ducted or water heating systems, or that would otherwise lock in future costs due to gas network decommissioning. However, this can unfairly force costs on to current premise owners (who may only be there for 4 years),or provide financing or other incentives to better align the costs and benefits over time.

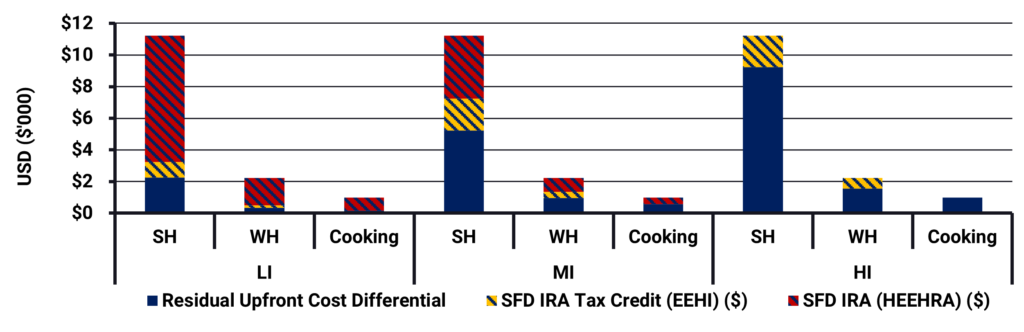

The Inflation Reduction Act (IRA) enacted in 2022 ,provides tax credits and funds to states, however, it only partially addresses the upfront cost barriers for consumers as shown in the figure . Additional financial strategies at the state and local level are still required to promote equitable and expansive electrification.

The most appropriate policy and regulatory framework depends on the situation, with the presence of government owned gas and electric utilities leading to a very different optimal policy and regulatory solution than where they are privately held, for example.

Addressing Grid Impact Barriers

Beyond the owner and occupier barriers, the impact of electrification on the electricity system can be a significant barrier, particularly where tariffs are not cost reflective, and higher electricity system costs fall on existing rather than transitioning demand.

The figure below provides an illustrative example of average electrification impact by end use. It shows that space heating could lead to a higher peak in the morning, where most electricity peaks are driven by summer air-conditioning load after solar PV output declines.

As long as the new load is not creating a new peak demand, and prices are cost reflective, it will lead to a general fall in electricity prices, as new demand is able to share the cost of existing infrastructure. However, once the capacity of existing infrastructure is exhausted, electrification could become the key driver of capacity expansion costs.

A key assumption in the above estimate is the mix of resistive vs. heat pump technology and the mix of instant rather than storage water heating technology. Resistive technology uses 2-3 times more electricity for space and water heating, and will drive a much higher morning peak, as does instant compared to storage water heating technology.

Best practice approaches to addressing the above barriers include regulations and incentives that encourage more heat pumps (which are storage based in nature), a reduction in heat pump costs (e.g. via R&D incentives) and discourage electric boosters in them.

Other best practice approaches focus on driving greater overall electric load flexibility via adoption and operation of the devices shown in the figure below, i.e. rooftop solar PV, batteries, and controllable loads such as at premise electric vehicle chargers and heat pumps.

Implementing the above best practices will have a major impact on the overall cost effectiveness of electrification.

Addressing Industry Capacity Barriers

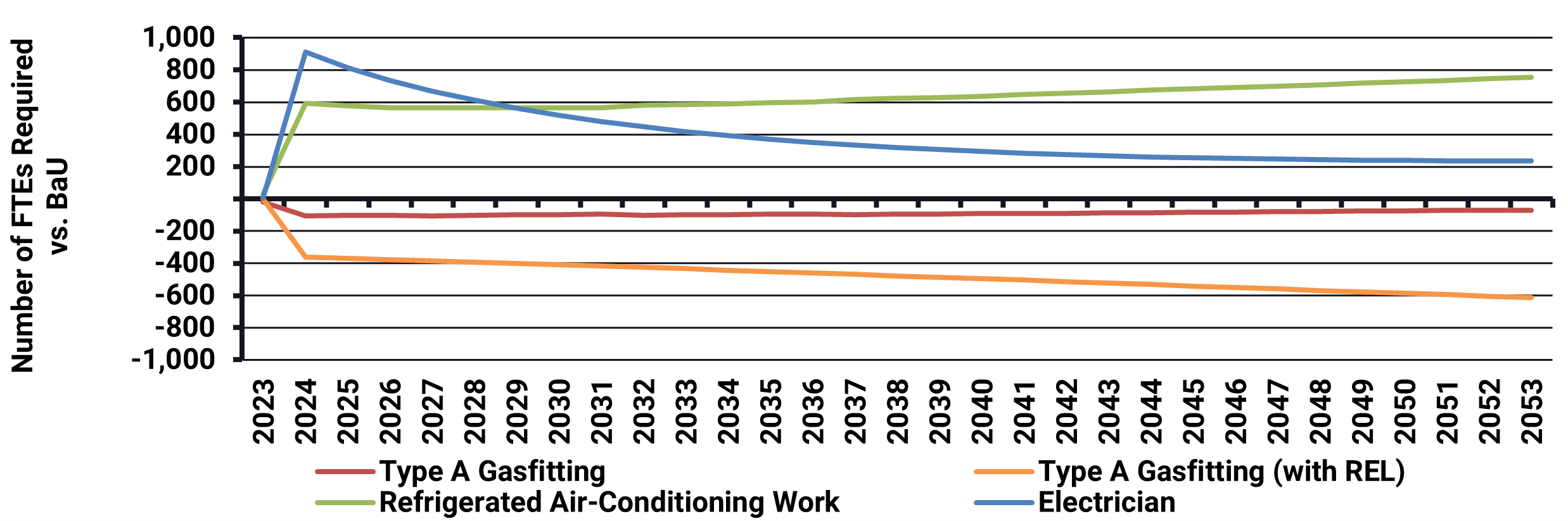

Another key issue facing policies and regulations that ban appliances that are currently a major portion of the market is the impact on the installation industry and the associated workforce. figure below illustrates this effect on the demand for different trades when implemented all at once in the first few years. It is unlikely that the industry can respond so quickly to the change in demand, leading to labor shortages, unemployment and higher consumer costs.

Of course, any significant changes to market conditions need to be communicated to the industry in a timely fashion. We have worked with clients to identify and engage with the workforce training elements of the economy to ensure sufficient retraining capacity is available.

Best practice approaches we have previously developed with clients including starting with incentives to encourage a more gradual increase in electrification, with any future bans on targeted technologies staggered across end of life, new / remodeling and customer segment.

Addressing Program Funding Barriers

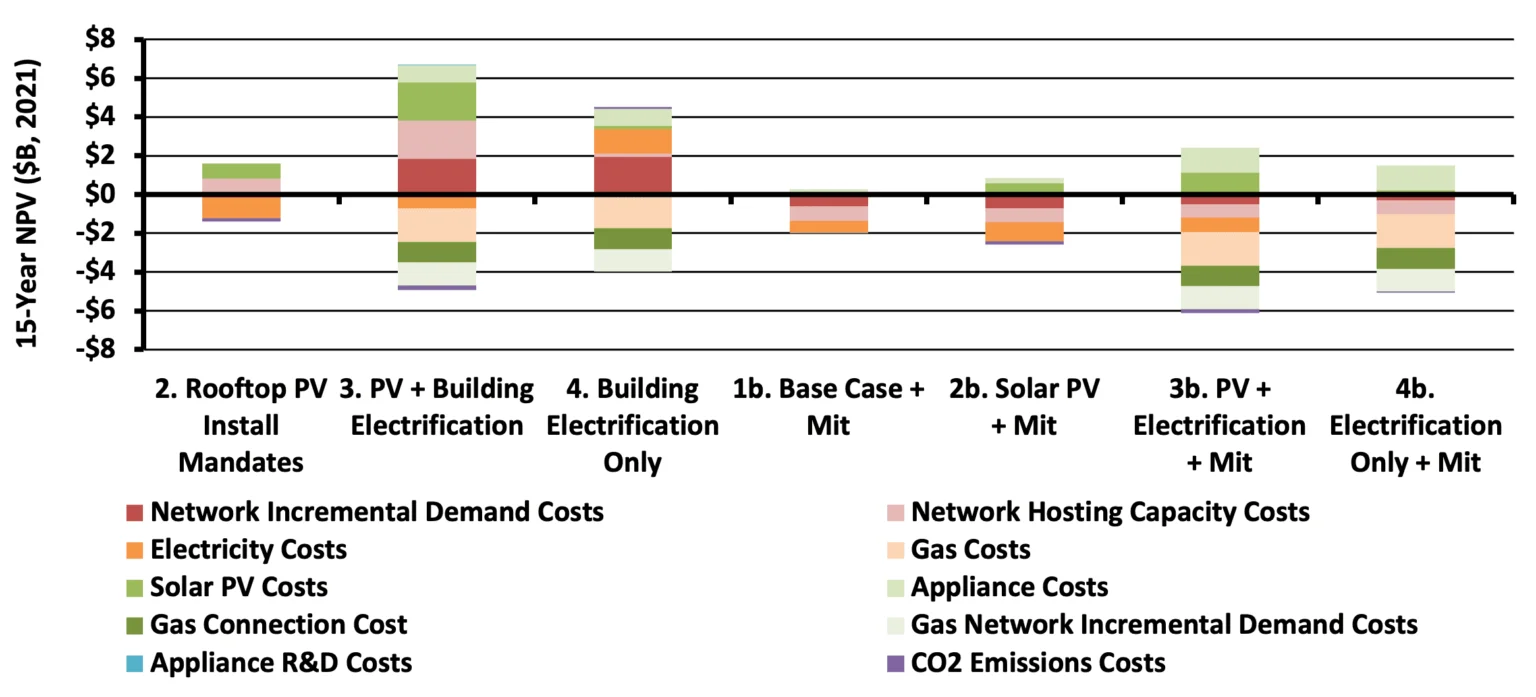

The combined effect of implementing best practice approaches to barrier removal has a dramatic effect on a given community’s costs and benefits from building electrification, as illustrated by the example outcomes across a range of base and optimized policy scenarios shown below.

The whole-of-system and stakeholder impact analysis Energeia conducted showed that 2 out of the 3 base policies resulted in a significant net cost increase. However, implementing best practice mitigation strategies resulted in the lowest overall cost, which was a significant savings compared to the ‘Do Nothing’ scenario (against which other scenarios were compared).

Takeaways and Recommendations

The cost impacts of electrification largely occur upfront, while the benefits occur over a longer period, up to 10-years or more. Costs can also impact on the owner and occupier differently, due to differences in tenancy duration and ownership. Addressing these barriers requires access to financing in a manner that accommodates changes in tenancy.

Best practice, self-funding strategies we have worked with clients to identify and implement include:

- Providing rebates or financing that address upfront cost differences, and recovering these costs via higher electricity rates or other techniques to better allocate costs

- Accessing CO2 credits or energy efficiency credits (which also translates into CO2 savings once the wholesale market is decarbonized)

We have also seen policymakers look to the tax base, including bonds, to provide financing. However, we have found that this has not been necessary to date, due to the availability of longer-term operating cost savings, and the ability to use energy pricing mechanisms for funding.

That being said, a key cost that has only been tested in very limited cases in the US is the cost of gas network decommissioning. The gas commissioning process is likely to entail rollout of electric appliances, which will be relatively high cost, and likely need to be compensated.

Energeia encourages careful analysis of net benefits from electrification and the consideration of policies that better capture excess benefits (i.e. windfall gains to certain stakeholder groups) so that any excess benefits may at least partially be used to fund the cost electrification, including gas system decommissioning as appropriate.

While beneficial overall in every jurisdiction that Energeia has analyzed, impacts from building electrification vary widely across premise types, consumer tenancy types, and time. Best practice policymaking and regulation focuses on mitigating the downsides, in part via capturing a portion of the potential upside.

Key Takeaways

- Building electrification is an essential part of the United State’s decarbonization pathway

- There are four main electrification triggers: new build, replacement, end-of-life, and retrofit

- Building electrification impacts different consumers differently

- Key barriers to electrification are higher upfront costs, higher grid costs, industry capacity constraints, and program funding

Electrification can impact on electricity sector costs, but these impacts can often be mitigated - Bans on appliances in new construction or at end of life can create step changes in workforce requirements

Key Recommendations

- Use bottom-up modeling of premises at the sub-load level to provide granularity needed to identify and size the key barriers and solutions

- Overcome cost barriers via financing or rebates, recovering these costs from imposts on electricity usage aligned with expected benefits

- Overcome electricity grid cost barriers by ensuring cost reflective pricing avoids cost shifting and cross-subsidies, and encouragement of load flexibility and management

- A largely unknown key risk is the cost of gas network decommissioning, which Energeia believes could be at least in part funded by repurposing electrification benefits

- Address potential industry labor constraints by giving industry plenty of notice, staggering any bans to minimize step changes in demand and ensure retraining capacity

You may also like

Optimizing Behind-The-Meter (BTM) Rates and Incentives

As rooftop solar PV, battery storage and ultimately, vehicle-to-x technologies, create generation alternatives and the means to store energy, artificial intelligence (AI) has the potential

Removing Building Electrification Barriers

Buildings account for a significant portion annual emissions, due to burning of gas for water and space heating, and for cooking.

Identifying a Least Cost CO2 Pathway

Be inspired to rethink CO2 emission analyses and its role in creating a more sustainable and prosperous future for everyone. Specifically, hear about cutting-edge methods